Over the past decade, programmatic advertising has revolutionized the digital marketing landscape. What began as a method for buying and selling online ad inventory at scale has morphed into a complex ecosystem of data, technology, strategies, and partnerships.

This rapid evolution has led to improved targeting, better transparency, and increased automation for marketers. However, with the endless changes in programmatic, many wonder — what’s next for the future of this space?

In this in-depth look at the programmatic advertising landscape, we’ll explore:

- The history and rise of programmatic advertising

- How priorities and focus areas have shifted over time

- Key trends and innovations shaping the next phase of programmatic

- Predictions for what’s to come in this fast-moving industry

Whether you’re an advertiser, publisher, agency, or programmatic partner, understanding programmatic’s past, present, and future is essential. By getting a handle on where things are headed, you can capitalize on emerging opportunities while future-proofing your strategies.

What is Programmatic Advertising?

Programmatic advertising involves using technology to buy and sell digital ads. It swiftly presents relevant ads to audiences through automated steps, all in less than a second. This is achieved by using algorithms and AI to conduct real-time auctions, purchasing, and placing ads the moment a visitor opens a website.

For example, Spotify employs programmatic advertising to send customized ads to users, considering their music choices and preferences. By using information about how users listen to music and what they like, Spotify can provide ads that really matter to them.

All digital formats and channels are accessible through these automated marketplaces. By employing workflow automation and machine learning algorithms, programmatic advertising ensures that the most effective ads are delivered to audiences, considering factors like geographic location or shopping behavior.

The important thing about programmatic advertising is that it makes creating ads and campaigns smoother. It also looks at how well your campaign is doing and helps you make it better for success.

How Does It Work?

When a person clicks on a website, the site’s owner uses a tool called a Supply-Side Platform (SSP) to signal Ad-Exchanges that they have space for ads available to be auctioned.

Advertisers, either through an agency or directly using a Demand-Side Platform (DSP), bid for this ad space. The DSP is connected to a data management platform (DMP) that ensures the ad reaches the right audience.

This is done by taking into account various factors such as the user’s location, characteristics, online behavior, and interests. Another technique called contextual targeting is used, where the ad appears based on the content of the website, like text, keywords, images, and categories.

The highest bidder’s ad is then displayed on the website. This entire process takes place in an incredibly short period of time.

Programmatic advertising isn’t limited to regular online ads only. It’s also used for advertising on smart TVs (CTV), digital radio, and even billboards and signs you see outside (out-of-home or OOH advertising).

What Is a Supply-Side Platform (SSP)?

A supply-side platform (SSP) is a special software for publishers that helps them sell spaces for ads using ad exchanges.

By connecting publishers with different ad exchanges, demand-side platforms, and networks all at once, SSPs let publishers sell their ad spaces to more possible buyers. It also lets publishers set the range of prices for the ads to get the most money they can.

What’s a Demand-Side Platform (DSP)?

A demand-side platform (DSP) is like special software for advertisers that helps them buy ads from lots of different places like SSPs, ad exchanges, ad networks, and even direct connections.

DSPs help brands and agencies decide which ads to buy and how much to pay for them. Advertisers can pick out who they want to show their ads to based on things like age, shopping habits, what they look at online, and other clues.

The Explosive Growth of Programmatic Advertising

Programmatic advertising didn’t always exist in its current advanced form. To understand the future, we have to look back at previous evolutions that brought us to this point.

The Early Days of Programmatic

In the mid-2000s, programmatic advertising started taking shape with the introduction of demand-side platforms (DSPs) and sell-side platforms (SSPs). These technology platforms allowed buyers and sellers to automate media buying and selling versus relying solely on manual ad transactions.

The major focus in these early days was operational efficiency. Advertisers could easily scale campaigns to reach broader audiences as inventory could be purchased rapidly across exchanges. Publishers benefited from being able to tap into increased demand and monetize ad inventory at higher prices.

The Rise of Real-Time Bidding

A major advancement for programmatic advertising came with real-time bidding (RTB). Instead of setting fixed prices for ad inventory, RTB enabled impression-by-impression auctioning. Advertisers could assess each individual impression and bid what they were willing to pay based on the value and relevance of that ad opportunity.

This more granular, auction-driven approach provided advertisers with more control over purchasing only the most suitable ad placements. Publishers could similarly generate higher yields by allowing buyers to bid up prices for coveted inventory.

According to Statista, real-time bidding accounts for over 80% of programmatic ad spending today. The auction model has become a fundamental part of programmatic transactions.

Targeting Gets Sophisticated

In addition to operational efficiency and real-time auctions, another major programmatic development was the use of audience data and segmentation. Advertisers could move beyond just buying placements to actually targeting specific groups within a publisher’s audience.

Leveraging data sources like first-party customer data, third-party data Exchanges, offline purchase data, and more, advertisers could build highly-specific audience segments and activate them using programmatic technology. Targeting specific customer demographics, interests, behaviors and more was now possible at scale.

According to Insider Intelligence, over 90% of US digital display spending currently runs through programmatic platforms. The ability to integrate data for precise audience targeting is a major factor fueling programmatic growth.

How Programmatic Advertising Priorities Have Evolved

With programmatic now solidly established, the focus has shifted from purely operational efficiencies to more strategic initiatives and advanced capabilities. The priorities of buyers, sellers, and other programmatic players have matured and evolved significantly over time.

More Collaboration Between Buyers and Sellers

In the early days, programmatic buyers and sellers operated fairly independently — buyers tried to get the lowest price and best inventory via exchanges while sellers tried to maximize yield in any way possible.

Now, there is much more collaboration between advertisers, agencies, DSPs, SSPs, and publishers. For example, advertisers create detailed programmatic partner strategies, and private marketplace deals, and work directly with publishers on data and technology integrations. The old bid vs ask dynamic has given way to buyers and sellers working together to drive mutual value.

According to Google Ads & Commerce Blog, over 70% of advertisers say collaborating with publishers on first-party data is a top priority. Working together via private marketplaces or programmatic direct setups has become prevalent.

Prioritizing Transparency

Lack of transparency into programmatic fees, inventory sources, data usage, and other key areas has been a major point of contention. In response, transparency has become a bigger priority across the programmatic advertising ecosystem.

Buyers are requiring much more visibility into what happens behind the scenes via supply path optimization. Publishers, DSPs, SSPs, and other vendors have responded by providing more visibility into their operations. Areas like tech fees/bitstream data, domain lists, pricing dynamics, and data leaks are now open to more inspection.

Focus on Supply Chain Optimization

With transparency improvements, advertisers are now looking at holistic supply chain optimization beyond just boosting performance at the media execution layer.

Steps like consolidating the number of programmatic vendors, curating approved partner lists, and taking back control via agency trading desks or in-housing are all examples of this focus on the full supply chain. The goal is end-to-end efficiency versus programmatic proficiency on the buy side alone.

According to a 2021 Digiday survey, 33% of US programmatic dollars were managed in-house compared to only 17% in 2019. Supply chain control is becoming increasingly important.

The Next Wave of Programmatic Advertising Evolution

Programmatic advertising is never standing still. As priorities and focus areas shift, what innovations are shaping the next phase of programmatic?

The ‘Death’ of the Third-Party Cookie

One major disrupting force is the phasing out of third-party cookies. With browsers like Google Chrome blocking these identifiers, advertisers can no longer rely on cookies for targeting and attribution.

This has kickstarted an industry-wide scramble to develop viable cookie alternatives. Options like contextual targeting, cohort modeling, and publisher first-party data integrations are emerging. However, there will likely be a patchwork of solutions versus just one replacement.

According to Marketing Dive, 38% of marketers say they have already made major changes to programmatic strategies as a result of the third-party cookie phaseout. Adapting to privacy-focused solutions is now key.

The Rise of New Media and Ad Formats

Programmatic thinking is also expanding beyond just online display into new mediums and ad formats. We’re seeing the application of programmatic principles across:

- Connected TV (CTV) – data-driven linear TV ad buying/selling at scale

- Digital out-of-home (DOOH) – automated buying of digital billboards

- Digital audio – data-driven ad insertion in podcasts

- Advanced TV – targeted buys of broadcast/cable TV

- New online ad formats – ads beyond just banner display (native, video, etc.)

According to Statista, DOOH programmatic ad spend is projected to reach $2.94 billion by 2023 in the US alone. Programmatic tactics that evolved in the online display are migrating across mediums.

The Integration of AI and Advanced Analytics

To execute, optimize, measure, and glean insights from rapidly evolving programmatic strategies, marketers are applying artificial intelligence (AI) and advanced analytics methods.

Sophisticated attribution modeling, lookalike modeling for audience expansion, supply path optimization algorithms, predictive budget pacing tools, and more demonstrate how AI is transforming programmatic. Voice assistants even allow for campaign management via conversational interfaces.

According to Juniper Research, AI-powered programmatic ads will account for 75% of all digital and mobile ad delivery globally. as data-driven automation enhances campaign performance. AI is becoming integral to programmatic.

What Does the Future Hold for Programmatic Advertising?

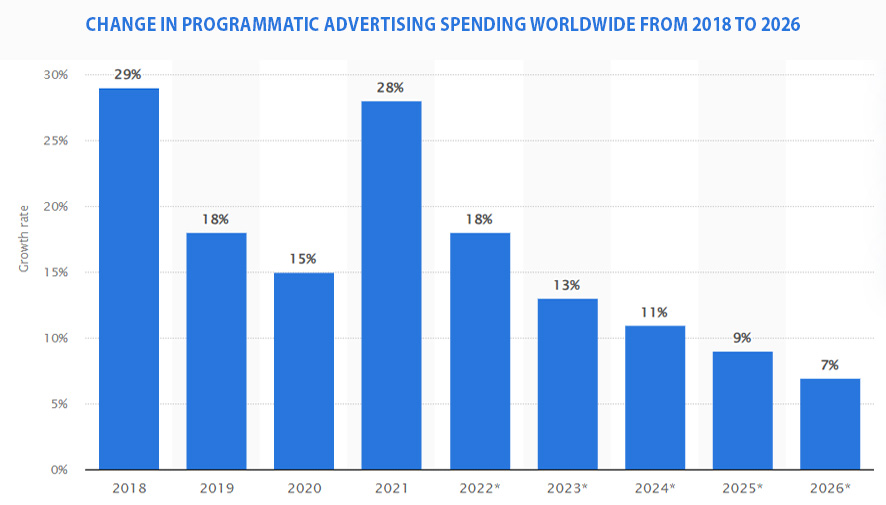

Given the priorities of today and the innovations happening now in the programmatic ecosystem, how might this translate to future developments? Statista data says the U.S. programmatic ad expenditure is poised to surpass $200 billion in 2023.

Here are 6 predictions for what lies ahead:

Cookie-Alternatives: Rise of First-Party Data

In January 2020, Google shook the digital landscape by declaring that, commencing 2022, its Chrome browser would cease to accept third-party marketing cookies. These cookies, which gather demographic insights about internet users—ranging from age and gender to product preferences and past searches—were facing extinction.

Enter first-party data, a powerful tool for context-based targeting that sidesteps the need for behavioral trackers like cookies and pixels while maintaining ad relevance. Predictions from Kenneth’s Research indicate a robust 18% CAGR for the contextual market between 2023 and 2035.

Developers are crafting new identification methods, such as Unified ID 2.0, requiring user-consented email addresses for targeting within apps or sites. Google Chrome is innovating with a ‘Privacy Sandbox‘ alternative to third-party cookies.

This approach enables private, transparent, interest-based ads by anonymizing data aggregation and limiting local device storage duration.

A Shift to ‘Why-Based’ Targeting

As third-party cookies go away and privacy becomes paramount, programmatic targeting will shift from purely who-based tactics to understanding the why behind customer actions. Read behavioral signals versus looking to identify audiences via cookies or demographics.

Rise of Connected TVs

According to Statista, the United States witnessed a record-breaking surge in connected TV usage in 2023, reaching an impressive 88 percent of American households owning at least one internet-connected TV device.

This striking statistic highlights the need for brands to prepare for the changing ways people watch content. Instead of solely relying on cable networks, advertisements will be shown more and more on connected TVs. This shift is giving rise to a whole new realm of possibilities for programmatic ad buying.

Shifting Towards In-House Campaigns

Brands are learning how to handle their own programmatic ad buying instead of relying on media agencies or middlemen. An emerging trend in programmatic advertising worth noting is the shift toward conducting in-house campaigns.

This shift can be understood as a reflection of the growing demand for transparency within the industry. Companies that opt for in-house programmatic operations can eliminate external intermediaries, granting them greater authority over their advertising campaigns.

According to IAB’s 2022 Attitudes to Programmatic Advertising Study, 57% of marketers consider the granularity of control and transparency of reporting the most important drivers for their in-house strategy.

Programmatic Advertising’s Multichannel Expansion

Programmatic advertising has evolved beyond traditional display ads, now encompassing social media, video, and audio platforms. This advancement empowers advertisers to target audiences seamlessly across diverse channels, cultivating a cohesive and impactful advertising strategy.

The surge in this trend is driven by smart speakers such as Amazon Echo and Google Home, transforming them into formidable instruments for delivering tailored advertisements to customers.

Streamlining Programmatic Advertising

As technology advances, programmatic advertising is on the brink of becoming easier and more effective. With the help of automation tools and AI-driven platforms, brands will manage campaigns effortlessly, while improved tracking will measure performance accurately. Imagine programmatic ad buying as simple as online shopping, just a few clicks away.

Looking ahead to 2023 and beyond, data analysis will play a central role. Brands will use algorithms to analyze data from various sources, including customer insights, to target the right audiences and deliver highly relevant ads.

This will result in more powerful campaigns that bring better returns on investment. In essence, the future of programmatic advertising promises a combination of straightforward processes and sharp targeting, leading to stronger marketing outcomes.

The Future Looks Bright for Programmatic Advertising

Even with the endless changes, programmatic advertising shows no signs of slowing down. As data utilization evolves, new media formats emerge, and innovative technologies like AI are applied, the programmatic landscape will continue rapidly advancing.

By continuously evaluating emerging tactics and tools through the lens of audience reach, operational efficiency, privacy compliance, supply chain transparency, and results, brands, agencies, and vendors can adapt programmatic strategies for future success.

Those who understand the evolutionary arc of programmatic and stay informed on where the industry is heading will be best positioned to capitalize on what’s next for this transformational form of digital advertising.